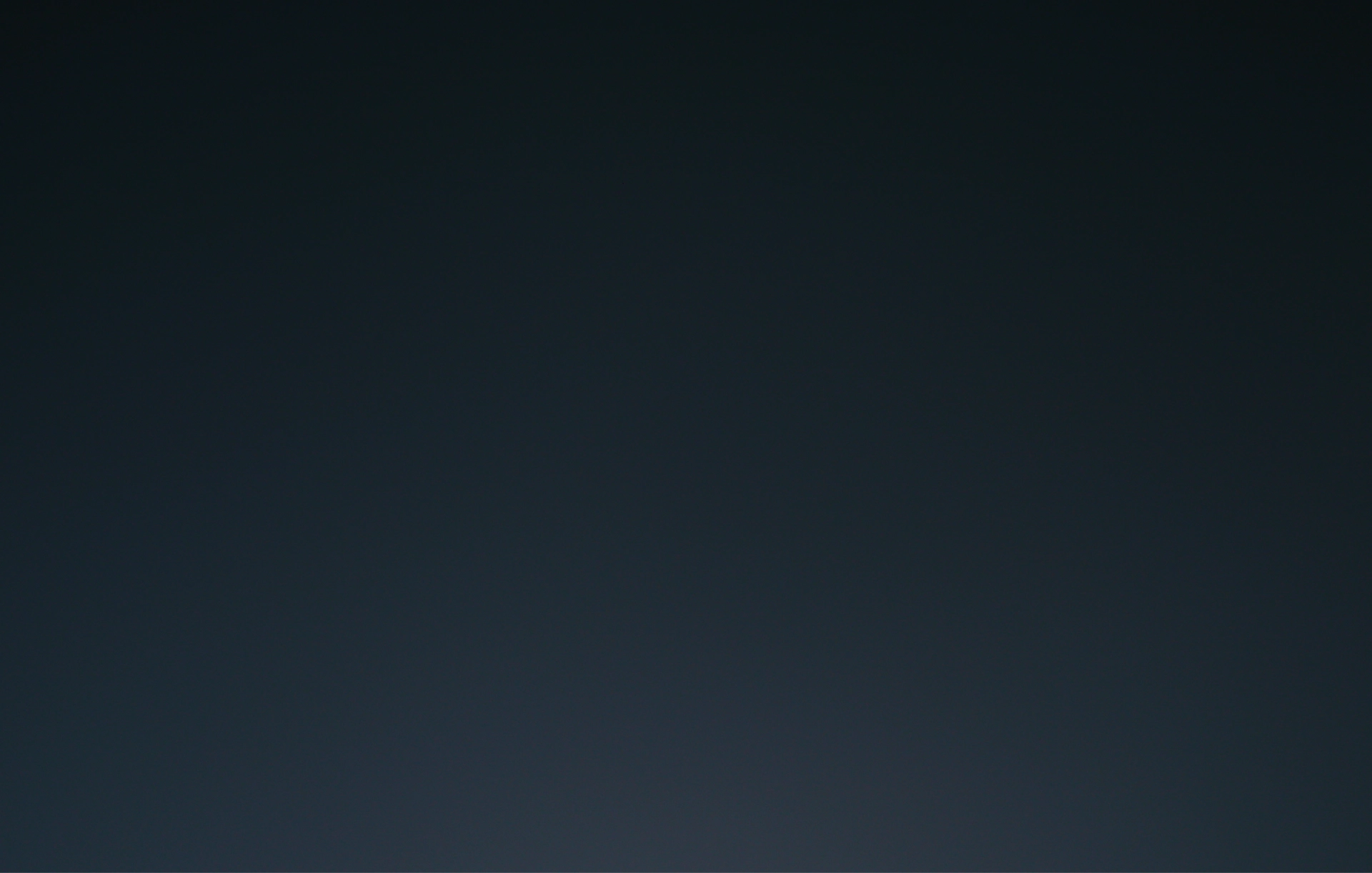

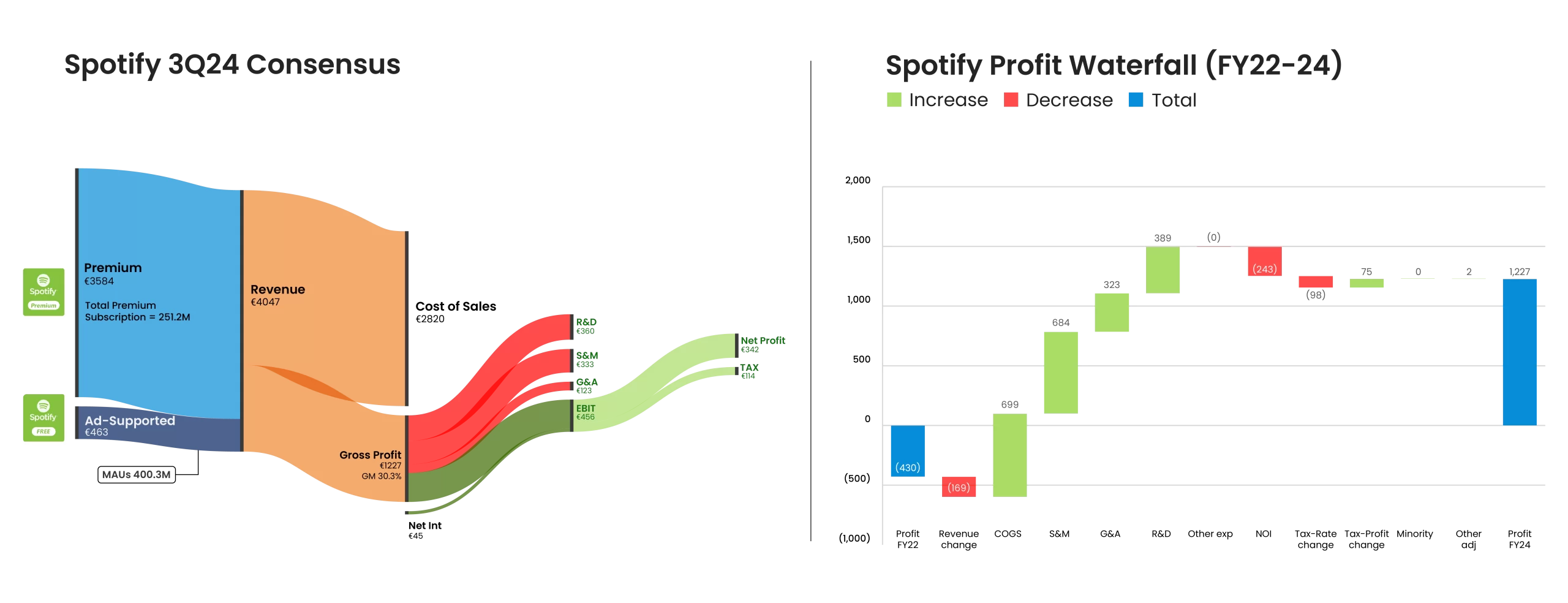

Explore our AI-powered Near Real-time Actuals and Granular Consensus (sourced from entitlement-based working sell-side models) datasheets.

Or have a look at a sample interactive Pre-Built Model with detailed GAAP/non-GAAP historicals, revenue & cost drivers, automated earnings and consensus updates, as well as guidance and valuation. You can change estimates to drive our models and compare to consensus simultaneously.

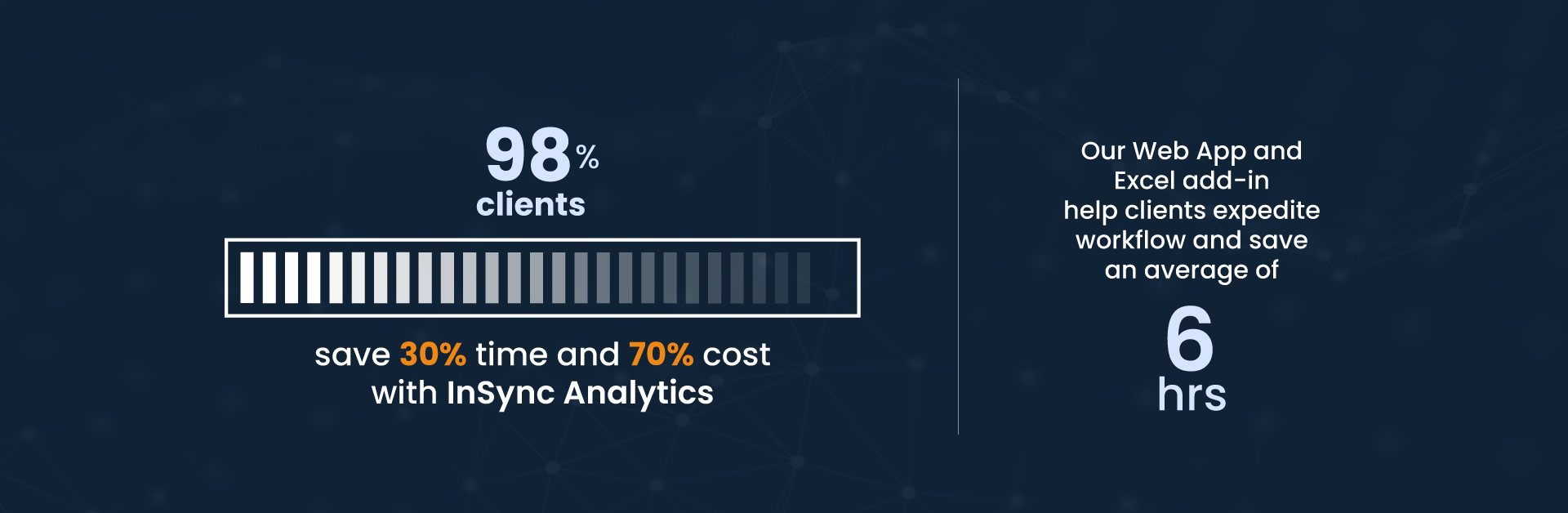

Or download our fully wired comps with detailed valuation and operating metrics for industry trends and forward-looking insights. You can customize these comps for your analysis with our Excel Add-in.